Mortgages and housing in Canada

This informtion was reposted from CMHC’s 2019 Mortgage Consumer Survey.

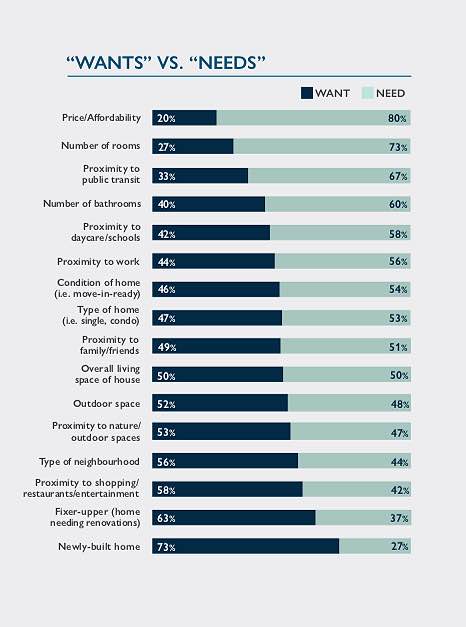

80% of buyers say price and affordability is key

Buyers identified price and affordability as a need to be addressed when purchasing a home. For the second consecutive year, about 30% of buyers indicated price/affordability as the top factor. Are you thinking of buying? CMHC can help you determine if you’re financially ready to purchase a home with CMHC’s homebuying guide, checklists and workbook.

47% of 2019 buyers were first-time homebuyers

This is a drop from 2018 when 56% of purchasers were first-time homebuyers. The percentage of repeat buyers increased from 44% in 2018 to 53% in 2019 and the majority of mortgage consumers are homeowners going through the renewal process. Learn more about the First-Time Home Buyer Incentive to get help you get into your first home.

81% of buyers said their current home meets their needs

It’s “home sweet home” for the majority of Canadians – 4 out of 5 homebuyers said their current house meets their needs. There are a lot of options and choices when it comes to finding the right home. We help Canadians make the best decision by guiding them through the various aspects to consider.

35% of buyers recognize the value of using a real estate agent

More and more Canadians see value in working with a real estate agent – this is up from 28% in 2018. Real estate agents can help recommend other home-buying professionals, including home inspectors, appraisers, builders or contractors, lawyers or notaries, insurance and mortgage brokers.

60% of buyers spent the maximum amount they could afford

The “house-rich, cash-poor” approach is losing momentum. We have seen a decrease from 78% to 60% of Canadians spending the maximum amount on their mortgage. Here are three tips to help you determine what price you can afford:

- Compare how much you currently spend on expenses and debt payments with the amount you have saved or invested.

- How much can you afford to spend on housing each month without risking your financial health?

- How much do you need to save to pay for the upfront costs of buying a home?

65% believe the “stress test” will keep more Canadians from taking on unaffordable mortgages

The “stress test” has been out for more than a year. The majority (59%) of homebuyers surveyed were aware of these new rules. Among all buyers, more than 75% said the changes had little or no impact on their decision to buy a home – down slightly from 80% in 2018. Those impacted reacted by purchasing a smaller or less expensive home.

30% of buyers don’t expect interest rates to rise in the next year

While mortgage rates were up in 2019, so was consumer optimism. More buyers were betting that interest rates wouldn’t rise again anytime soon.

23% of buyers said their current level of debt is higher than they were expecting

Consumer debt continues to be a significant challenge in nearly every part of the country. The impact of those debts also continued to spill over into the mortgage markets. In total, around 23% of homebuyers in 2019 said their current level of debt is higher than they were expecting. This number is up from 19% of buyers in 2018.

30% of buyers didn’t have a monthly budget before buying a home

Preparing a monthly budget — and sticking to it — is one of the keys to successful homeownership. One third of homebuyers surveyed didn’t have a monthly budget before buying a home but more than two thirds (69%) operated on a monthly budget as a homeowner. This worksheet can help Canadians develop their budget and meet their financial goals.

87% of buyers feel confident that buying a home is a sound long-term investment

The majority of homebuyers are confident that buying a home is a sound long-term investment. Before deciding that buying a home is the right decision for you, we encourage all Canadians to carefully examine what type of housing is best for them by asking themselves these five questions.

Do you have any questions about these videos or highlights from the consumer survey? Contact one of our sales representatives today for more information.